PRIVATE EQUITY

Unlocking Technology Alpha through Digital Transformation

Our Mission Statement

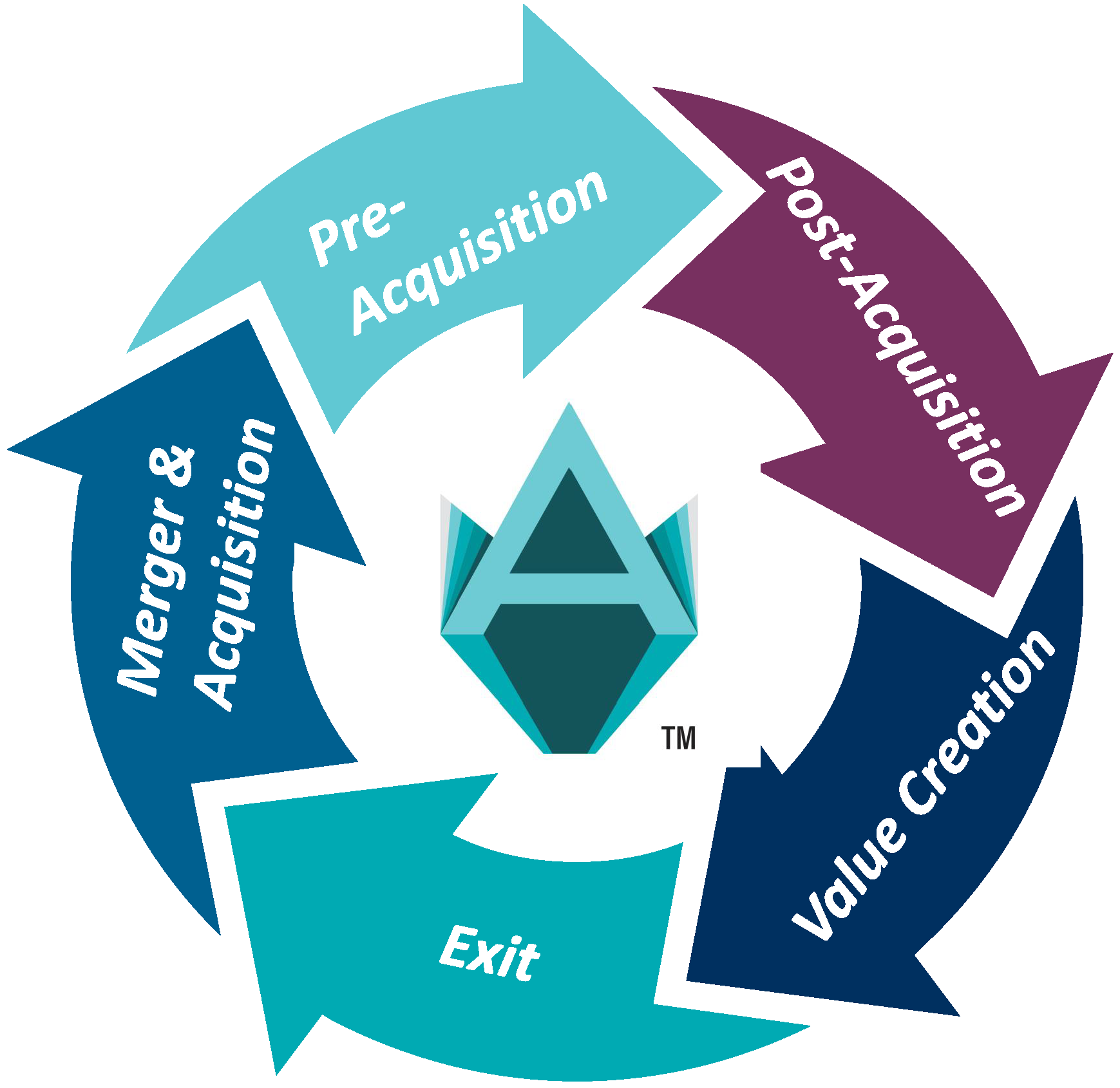

Unlocking business value through exit by identifying and sourcing the right technology platforms and management. Technology is no longer a cost center but a value creation lever and differentiator.

Value Creation

To challenge the status quo of vendor partnership agreements and to address the issues of low adoption, lack of ROI, and missed value creation opportunities, a new approach can be proposed. This approach aims to empower portfolio companies with the necessary expertise and support to tackle sourcing projects aligned with Private Equity’s operational goals, without relying solely on consulting firms

Protecting Enterprise Value

Protecting enterprise value for portfolio companies through cybersecurity advisory is a crucial aspect of managing investments in the digital age. By implementing cybersecurity advisory measures, we can help portfolio companies enhance their security posture, protect enterprise value, and minimize the potential impact of cybersecurity incidents.

Why Accelerates’ team is your secret weapon…

Former Technology Operating Executive Experience, Why this makes a difference…

As a former operating executive, there are several areas of first-hand knowledge that can be valuable to a private equity firm when evaluating investments. Here are some key areas where our expertise can contribute:

Industry Insights:

Our deep understanding of the IT, Cloud, Cybersecurity managed services industry in which the potential investment operates is crucial. Our knowledge of market dynamics, competitive landscape, customer behavior, and emerging trends can help the private equity firm assess the investment’s growth potential, competitive advantage, and potential risks.

Operational Expertise:

Private equity firms often seek operating executives who have a track record of successfully managing and optimizing businesses. Our experience in areas such direct and alternate channel sales, marketing, go to market strategy, and product sets and finance can provide valuable insights into the investment’s operational strengths, weaknesses, and opportunities for improvement.

Strategy Development:

Our strategic thinking and experience working with technology managed service providers in developing business strategies can help evaluate the investment’s positioning within the market. We can assess the effectiveness of the current strategy, identify potential strategic initiatives, and evaluate the investment’s ability to execute its strategic objectives.

Leadership and Management:

Our knowledge of effective leadership and management practices can help evaluate the quality and effectiveness of the investment’s management team. You can assess the team’s capabilities, alignment with the business strategy, and their ability to execute operational and strategic plans.

Network and Relationships:

Our professional network and relationships within the industry can be valuable assets. We may have connections with potential customers, suppliers, industry experts, or other key stakeholders that can provide insights and support the investment’s growth objectives.

Industry Insights:

Our deep understanding of the IT, Cloud, Cybersecurity managed services industry in which the potential investment operates is crucial. Our knowledge of market dynamics, competitive landscape, customer behavior, and emerging trends can help the private equity firm assess the investment’s growth potential, competitive advantage, and potential risks.

Operational Expertise:

Private equity firms often seek operating executives who have a track record of successfully managing and optimizing businesses. Our experience in areas such direct and alternate channel sales, marketing, go to market strategy, and product sets and finance can provide valuable insights into the investment’s operational strengths, weaknesses, and opportunities for improvement.

Strategy Development:

Our strategic thinking and experience working with technology managed service providers in developing business strategies can help evaluate the investment’s positioning within the market. We can assess the effectiveness of the current strategy, identify potential strategic initiatives, and evaluate the investment’s ability to execute its strategic objectives.

Leadership and Management:

Our knowledge of effective leadership and management practices can help evaluate the quality and effectiveness of the investment’s management team. You can assess the team’s capabilities, alignment with the business strategy, and their ability to execute operational and strategic plans.

Network and Relationships:

Our professional network and relationships within the industry can be valuable assets. We may have connections with potential customers, suppliers, industry experts, or other key stakeholders that can provide insights and support the investment’s growth objectives.

Overall, Our first-hand knowledge as an operating executive brings a practical perspective that helps the private equity firm assess the investment’s industry dynamics, operational potential, strategic fit, performance improvement opportunities, and the capabilities of the management team. Our insights can significantly enhance the firm’s decision-making process and increase the likelihood of successful investments.

Portfolio Company Programs and Benefits

Having technology consulting expertise in areas such as IT, cybersecurity, assessments, vulnerability scans, risk identification, and proactive recurring programs can provide significant benefits to both the private equity firm and its portfolio companies. Here are five reasons, supported by credible sources, why this expertise is valuable:

Enhancing Cybersecurity:

Our team can help identify and address cybersecurity risks, ensuring that portfolio companies have robust security measures in place.

Mitigating Operational Risks:

Our team with the help of strategic suppliers can conduct assessments, vulnerability scans, and risk identification exercises to identify potential weaknesses and vulnerabilities within a company’s IT infrastructure. By addressing these risks proactively, portfolio companies can mitigate operational disruptions, minimize the likelihood of system failures or breaches, and protect critical business processes.

Enabling Growth and Innovation:

We can assist portfolio companies in developing technology strategies that align with their business objectives. The technology managed service providers utilize lots of technology tools for assessment, management and prevention. New technology advancements occur each day and our team keeps tabs on the latest and greatest used by the industry.

Facilitating Due Diligence and Value Creation:

Our expertise has been used by many private equity firms to support the due diligence processes and post-acquisition value creation efforts. By assessing the target company’s technology infrastructure, evaluating IT risks, and identifying potential synergies and improvement opportunities, the firm can make informed investment decisions and develop actionable plans to enhance the value of the portfolio company.

Enhancing Cybersecurity:

Our team can help identify and address cybersecurity risks, ensuring that portfolio companies have robust security measures in place.

Mitigating Operational Risks:

Our team with the help of strategic suppliers can conduct assessments, vulnerability scans, and risk identification exercises to identify potential weaknesses and vulnerabilities within a company’s IT infrastructure. By addressing these risks proactively, portfolio companies can mitigate operational disruptions, minimize the likelihood of system failures or breaches, and protect critical business processes.

Enabling Growth and Innovation:

We can assist portfolio companies in developing technology strategies that align with their business objectives. The technology managed service providers utilize lots of technology tools for assessment, management and prevention. New technology advancements occur each day and our team keeps tabs on the latest and greatest used by the industry.

Facilitating Due Diligence and Value Creation:

Our expertise has been used by many private equity firms to support the due diligence processes and post-acquisition value creation efforts. By assessing the target company’s technology infrastructure, evaluating IT risks, and identifying potential synergies and improvement opportunities, the firm can make informed investment decisions and develop actionable plans to enhance the value of the portfolio company.

Accelerate Partners Private Equity Practice is a strategic resource, for more information please contact us today!

Accelerate Partners vs BIG 4 Consulting

Focused on Execution

More Flexible

Seasoned Operating Executives

More Nimble

A Track Record of Success

Easy to do business with

What people are saying about Accelerate Partners

“You are someone we keep at the top of our list of go to firms”

Managing Director,

Private Investment Firm that Focuses on Technology Companies

“Your firm is positioned well to help us with our portfolio companies’ IT assessment and investment strategies”

Vice President,

Private Equity for Middle Market Companies

“Accelerate Partners serves as our technology and cybersecurity operating advisory team. They help us navigate the maze of providers and solutions in the market to help our companies optimize technology spend”

General Partner,

Investment Professional

Our mission is to unlock substantial business value for organizations by strategically identifying and sourcing the right technology platforms and management solutions. We recognize that in today’s dynamic business landscape, technology has transformed from being a mere cost center into a powerful catalyst for value creation and a key differentiator.

We are committed to helping businesses harness the potential of technology to drive growth, innovation, and competitive advantage. By carefully analyzing market trends and understanding the unique needs of each organization, we provide expert guidance in selecting the optimal technology platforms and solutions that align with their strategic objectives.

Our approach goes beyond mere implementation; we focus on delivering comprehensive value throughout the entire business lifecycle. We collaborate closely with our clients to ensure seamless integration, efficient operations, and continuous improvement. By leveraging technology effectively, we enable organizations to streamline processes, enhance customer experiences, and accelerate time-to-market, ultimately leading to increased profitability and sustainable success.

We pride ourselves on our deep industry knowledge, extensive network of technology partners, and our ability to stay ahead of emerging trends. Our team of experienced professionals combines business acumen with technical expertise to provide insightful recommendations and implement innovative solutions that drive tangible business outcomes.

At the heart of our mission is the belief that technology should be a strategic enabler, fueling growth and unlocking new opportunities for organizations across industries. We strive to be the trusted partner that empowers businesses to embrace the transformative power of technology, positioning them for long-term success in an ever-evolving digital landscape.